omaha nebraska vehicle sales tax

These plates will be valid for 30 days. The December 2020 total.

Making Cents Why Nebraska Should Modernize The Sales Tax Pt 1

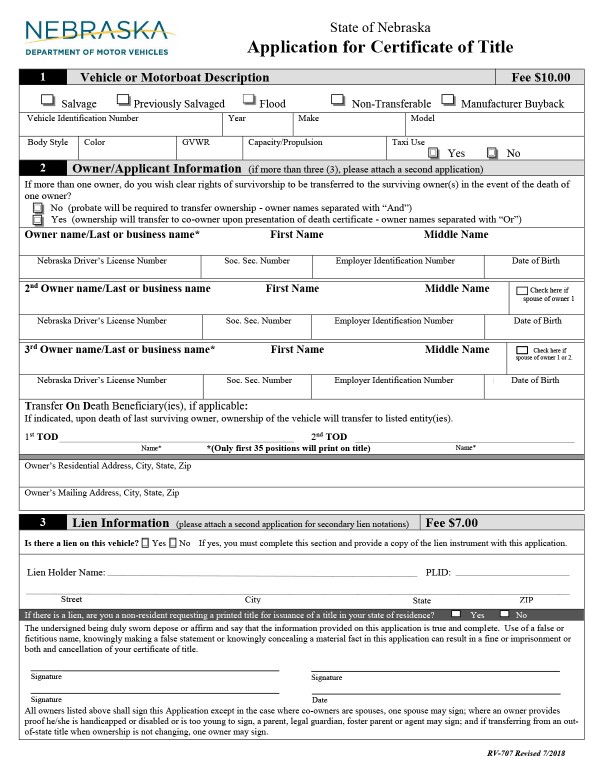

If you are registering a motorboat contact the Nebraska Game and Parks Commission.

. Repair labor on motor vehicles. 2020 Net Taxable Sales. This is the total of state county and city sales tax rates.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022 updated 06032022 Effective October 1 2022 the village of Bruning and the city of Humboldt will start a local sales and use tax rate of 15. 2020 Net Taxable Sales. The typical state and local sales tax in Nebraska is about 7 percent Conroy said so the buyer could save 14000 on an RV costing 200000.

The minimum combined 2022 sales tax rate for Omaha Nebraska is. To register an apportioned vehicle vehicles over 26000 pounds that cross state lines contact the Department of Motor Vehicles Motor Carrier Services. The Omaha sales tax rate is.

Department of Motor Vehicles. This is because the first bracket is fairly wide 0 - 3999 and has only a 25 tax when new. Registration fee for farm plated truck and truck tractors is based upon the gross vehicle.

The Omaha Sales Tax is collected by the merchant on all qualifying. Subsequent brackets increase the tax 10 to 40 for each 2000 of value when new or two percent. Greater Omaha Chamber of Commerce UNO.

2020 Sales Tax 55. The Registration Fees are assessed. Questions regarding Vehicle Registration may be addressed by email or by phone at 402 471-3918.

There are no changes to local sales and use tax rates that are effective July 1 2022. 700 Is this data incorrect Download all Nebraska sales tax rates by zip code. 2020 Sales Tax 55.

1500 - Registration fee for passenger and leased vehicles. The Nebraska sales tax rate is currently. You can find these fees further down on the page.

An Omaha man charged with felony motor vehicle. What is the restaurant tax in Omaha. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax.

Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. 2021 Sales Tax 55. Youll need the title or Manufacturers Statement of Origin MSO and the fee of 2010.

4 rows The current total local sales tax rate in Omaha NE is 7000. Taxes-Consultants Representatives Tax Return Preparation Accounting. 301 Centennial Mall South PO Box 94789 Lincoln NE 68509- 4789 402 471-3918 State of Nebraska.

Youll also receive a temporary registration certificate. 2020 Net Taxable Sales. 2021 Sales Tax 55.

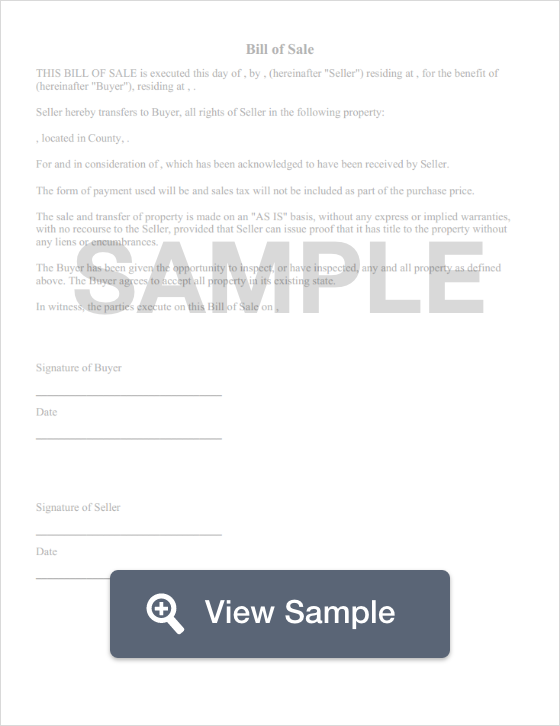

This is less than 1 of the value of the motor vehicle. This Bill of Sale form is made available by the Nebraska Department of Motor Vehicles as a courtesy. 1819 Farnam Omaha NE 68183 402 444-7103.

State Sales Tax 184718 Motor Vehicle Tax 700 Local Sales Tax 50378 Omaha Wheel Tax 50 Motor Vehicle Fee 30 Passenger. The Nebraska sales tax rate is currently. State Sales Tax 184718 Motor Vehicle Tax 700 Local Sales Tax 50378 Omaha Wheel Tax 50 Motor Vehicle Fee 30 Passenger Registration 2050 Plate Fee 660.

According to the city 2300 restaurants are required to pay the restaurant tax which is a 25 occupation tax on the gross receipts from sales of prepared food and beverages. 2020 Sales Tax 55. Registration fee for commercial truck and truck tractors is based upon the gross vehicle weight of the vehicle.

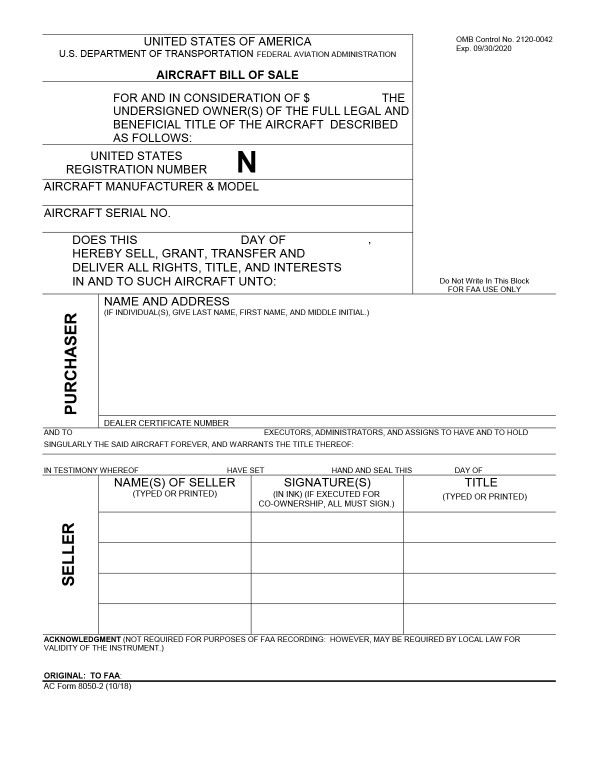

Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. 29 000 For An Average Used Car In Us Would Be Buyers Are Aghast Search our Omaha Nebraska Sales And Use Tax database and connect with the best Sales And Use Tax Professionals and other Attorney Professionals in Omaha Nebraska. You can drive your new car to Kansas after obtaining non-resident license plates at the County Treasurer from the county in which you purchased the car.

2021 Sales Tax 55. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2. The higher the value of the passenger vehicle the smaller the share of the vehicle that is.

This example vehicle is a passenger truck registered in Omaha purchased for 33585. The exception to this is a vehicle that is currently titled in the name of the purchasers parentguardian or. The County sales tax rate is.

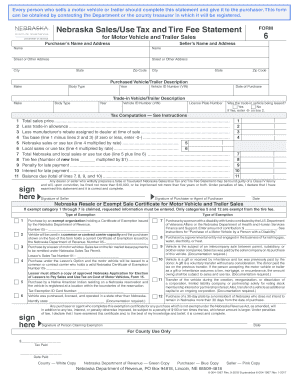

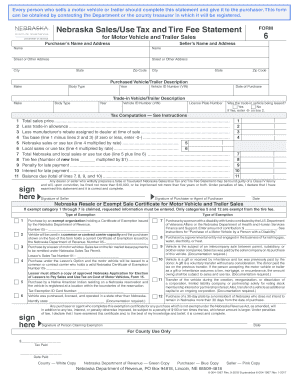

Which in turn is used to complete the Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6 as a trade-in must be titled in the name of the purchaser. In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees. BILL OF SALE DATE OF SALE.

The Nebraska state sales and use tax rate is 55 055.

Latest Information On Dmv Services Nebraska Department Of Motor Vehicles

Motor Vehicles Douglas County Treasurer

2021 Ne Dor Form 6 Fill Online Printable Fillable Blank Pdffiller

The Nebraska State Constitution Nebraska Press

Sales Tax On Cars And Vehicles In Nebraska

Free Nebraska Bill Of Sale Templates Pdf Docx Formswift

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Motor Vehicles Douglas County Treasurer

Contact Us Nebraska Department Of Revenue

Superlative 1927 Sinclair Aviation Gasoline Restored American Visible Gas Pump Model 2487 Barrett Jackson Auction Vintage Gas Pumps Gas Pumps Petrol Station

2021 Ne Dor Form 6 Fill Online Printable Fillable Blank Pdffiller

Contact Us Nebraska Department Of Revenue

Nebraska State Tax Things To Know Credit Karma

All About Bills Of Sale In Nebraska The Forms And Facts You Need

Nebraska Cornhuskers Logo Wordmark Logo 1992 2011 Sportslogos Net Word Mark Logo Nebraska Cornhuskers Cornhuskers

All About Bills Of Sale In Nebraska The Forms And Facts You Need

2021 Ne Dor Form 6 Fill Online Printable Fillable Blank Pdffiller

All About Bills Of Sale In Nebraska The Forms And Facts You Need